India Commercial Real Estate Market (2024 - 2029)

Market Size of India Commercial Real Estate Industry

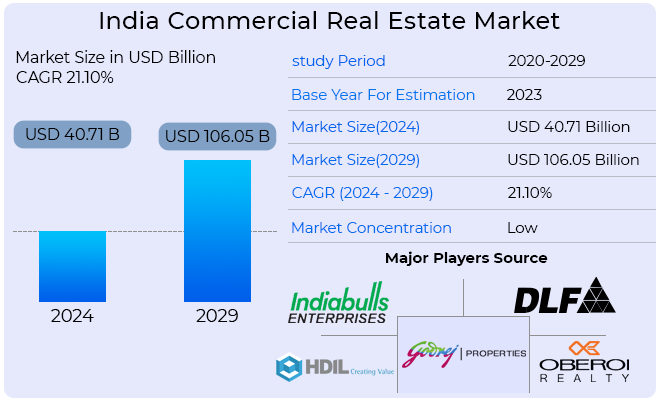

The India Commercial Real Estate Market is predicted to be worth USD 40.71 billion in 2024, rising to USD 106.05 billion by 2029, with a CAGR of 21.10% during the projection period.

The COVID-19 epidemic created a work-from-home (WFH) culture, which had a short-term impact on new space requirements. In 2022, new office space in seven Indian cities (Mumbai, Delhi NCR, Bengaluru, Hyderabad, Chennai, Kolkata, and Pune) reached 38.25 million square feet, a 30% decrease from the previous year. In the first quarter of 2023 (January-March), net office absorption in the top six cities was 8.3 million sq. ft.

According to industry experts, beginning September 2022, grade A offices in Indian cities such as Bengaluru and Mumbai will have an average cap rate of 8.25 in core areas. In comparison, the average cap rate for grade A offices in Taipei that year was 2.35 percent. Other Gurugram regions had the highest total vacancy rate of 35.9% in the second quarter of that year. According to industry experts, the Cybercity of Gurugram in India had the lowest vacancy rate among other market segments of the Delhi NCR region at 5.4%.

The commercial real estate market is seeing notable growth in the retail and hospitality sectors, supplying India's expanding demands with the infrastructure it needs. Large-scale institutional investments are anticipated to drive India's commercial real estate sector in the upcoming years. The country's retail real estate market has experienced a significant surge because to government programs like Make in India and other real estate reforms including the implementation of the Real Estate Regulatory Authority (RERA) and GST.

Developers and purchasers are gravitating towards the commercial real estate sector despite their initial difficulties because of the industry's transparency and expertise, which has drawn more and more foreign direct investments (FDI) in commercial real estate. The demand for commercial real estate is being driven by the GDP growth of the nation. It is expected that government programs and urban development regulations and initiatives (Smart City, AMRUT) will increase demand for real estate infrastructure.

The country's need for office space is fuelled by factors including convenience, comfort, and flexibility. To house their staff, the majority of companies across a range of industries—including IT, manufacturing, BFSI, startups, and even boutique businesses—are searching for office space. Furthermore, a lot of businesses want to build satellite or remote offices, grow into new regions, or both, which will increase demand for these spaces.

India's Market Segmentation for Commercial Real Estate

Commercial real estate (CRE) is only used for business purposes or to provide a workspace, as opposed to residential real estate. Most renters lease commercial real estate to run cash-generating businesses.

The report contains a comprehensive background analysis of the India Commercial Real Estate Market, including an assessment of the economy and the contribution of sectors to the economy, a market overview, market size estimation for key segments, emerging trends in market segments, market dynamics and geographical trends, and the impact of COVID-19. The Indian commercial real estate market is divided into four categories: offices, retail, industrial and logistics, and hospitality, as well as key cities such as Mumbai, Bangalore, Delhi, Hyderabad, and others. The study provides market estimates and predictions for the Commercial Real Estate Market in India in value (USD) for each of the aforementioned segments.